RBI

RBI

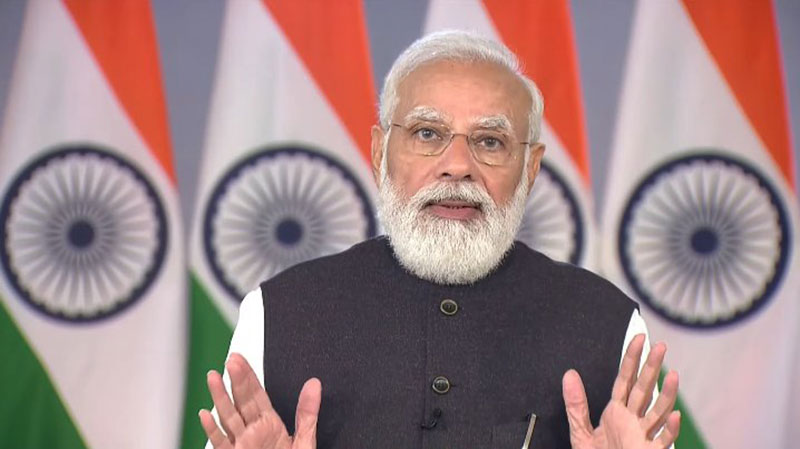

PM Modi launches RBI scheme to allow retail investors directly buy govt securities

New Delhi/UNI: Providing salaried class, pensioners and retail investors direct access to the government securities market, Prime Minister Narendra Modi on Friday launched the Reserve Bank of India (RBI)'s Retail Direct Scheme.

Under the scheme, small individual investors could open Retail Direct Gilt Account’ (RDG Account) with the RBI and buy government securities directly without the need for any intermediaries.

The scheme seeks to widen the investor base for government securities by creating an ecosystem whereby retail investors can easily participate in the government securities market which has so far been dominated by institutional investors.

Launching the scheme, Modi said that it is a simple and secured medium for small investors to invest in government securities.

He also launched the Integrated Ombudsman Scheme of the central bank which seeks to further improve the grievance redress mechanism for resolving customer complaints against banks, NBFCs and payment system operators and all other entities regulated by RBI.

The Integrated Ombudsman Scheme would subsume all previous schemes and offer the benefits of a single platform to customers for getting speedy resolutions of their grievances. The integrated scheme is expected to reinforce confidence and trust in the financial system.

Launching the scheme virtually, the Prime Minister said that through the integrated ombudsman scheme "One nation One ombudsman" system has been put in place in the banking sector.

"The launch of two people-centric schemes of the RBI will ensure widening of the scope of accessing capital markets for retail investors," Modi said.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.