Income Tax Bill

Income Tax Bill

Lok Sabha passes modified Income Tax Bill, 2025, without debate

The Lok Sabha on Monday passed the modified new Income Tax Bill, 2025 and the Taxation Laws (Amendment) Bill, 2025.

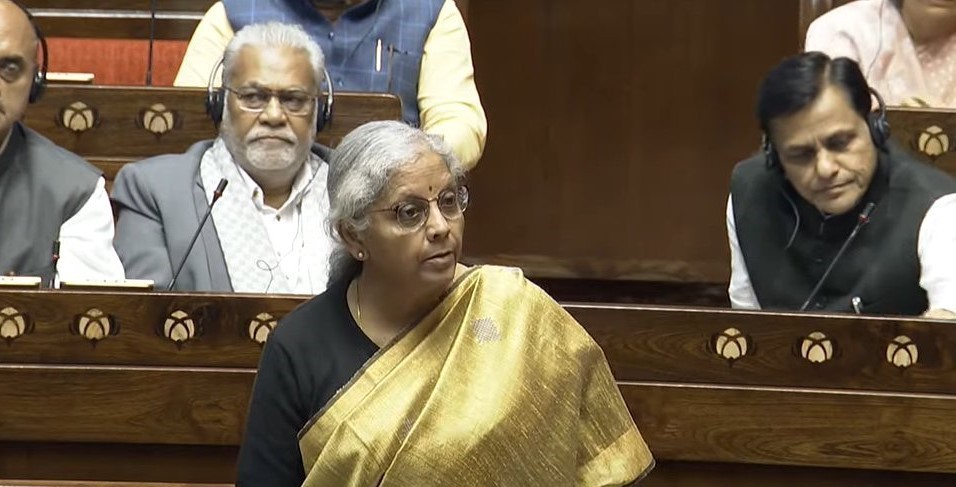

The Income Tax (No 2) Bill, 2025, was passed shortly after Finance Minister Nirmala Sitharaman tabled the bill in the house.

#monsoonsession2025#LokSabha passes The Taxation Laws (Amendment)

— SansadTV (@sansad_tv) August 11, 2025

Bill, 2025

The Bill further amends the Income-tax Act, 1961, and the Finance Act, 2025.@nsitharamanoffc @nsitharaman @LokSabhaSectt@loksabhaspeaker pic.twitter.com/6NJk0EHJeQ

The Lok Sabha was adjourned for the day immediately after new Income Tax Bill, 2025 was passed.

The Bill now needs to be passed from the Rajya Sabha and then seek the President's nod.

“Almost all of the recommendations of the Select Committee have been accepted by the government. In addition, suggestions have been received from stakeholders about changes that would convey the proposed legal meaning more accurately,” said the statement of objects and reasons of the modified Income Tax Bill, 2025 as quoted by Mint.

As per a statement issued by the Indian government, the Income Tax Bill, 2025 seeks to replace the existing Income Tax Act, 1961 which has seen multiple amendments over the years.

It retains basic tax provisions of the existing act and primarily aims to simplify the language and remove redundant provisions.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.